Wednesday 13 June 2012

Previously, we learnt the

definition of technical analysis as a study of prices and charts to predict a trend and the assumptions behind this method of forecasting.

This time, we will give you an insight into various prices and price charts that could help you in carrying out the analysis.

Classification of Prices

The prices of scrips vary significantly throughout the day. This is because at any point of time the price is determined by the demand and supply for that scrip. If demand is more than the supply, the price will go up and vice versa. While a seller will always ask for a higher price for the shares he is selling, a buyer will be on the lookout for a lower price for the stock that he is buying. The price at which trades take place is known as the trade price.

There are four basic ways through which price movements in a day may be depicted for the purpose of our analysis. These prices may be termed as open, high, low and close. These terms mean exactly what their names suggest. The ‘Open’ price is the price at which the first trade of the day in the scrip has taken place. Thus, it is the trade price of the first trade. The ‘High’ is the highest price reached by the scrip during the day. ‘Low’ is the lowest price during the day and ‘Close’ is the last price of the day at which a trade has occurred in the scrip.

These prices are depicted by way of charts and help in carrying out analysis. While a few technical analysts use all the four prices for their analysis (especially those using Japanese analytical methods such as the Candlestick technique), others are mostly concerned with the high, low and close prices for their analysis and plotting.

If you glance over any pink sheet, you will come across these prices given in the same pattern. For example, if the price of Reliance Industries (Reliance), for say January 15, 2008, is given in the following way: Reliance, 3150, 3245, 3125, 3190; it means that the open price of the scrip Reliance based on trading on the stock exchange on January 15, 2008 was Rs 3,150. The price touched an intra day high of Rs 3,245 and low of Rs 3,125 and finally closed at Rs 3,190. These prices may also be copied into a work sheet which is termed as ‘Bhav Copy’ in the terminology of the domestic stock exchange.

Date

|

Open

|

High

|

Low

|

Close

|

15.01.08

|

3150

|

3245

|

3125

|

3190

|

If only two prices are depicted against the scrip of Reliance for a particular day, say Reliance, 3200, 3225; then, it must be read in the same manner - The first price (3200) is the open price and the second price (3225) is the close price. The higher of the two i.e. 3225 is the intra day high and the lower of the two, i.e. 3200, is the low price clocked for the day. If only one price is displayed against a scrip for a day, it can be considered as the open, high, low and close price and will be depicted accordingly.

Again, instead of depicting prices on a daily basis, prices can also be depicted on a weekly basis. For example, the

price of Reliance may be shown as follows for the week ended January 18, 2008: RIL, 3100, 3330, 2985, 3300. This would signify that 3100 is the open price as on the first day of the week, i.e. the first trade of January 14. The next in the series, 3330, is the high for the week and 2985 is the low for the week. The last price, i.e. 3300, is the close price of the last day of the week i.e. as on January 18, 2008.

Plotting of Prices

The price list or Bhav copy so prepared has to be plotted in a chart for the purpose of analysis. Charts are the first stepping stone towards depicting price movements and figuring out any trends therein. Hence, price charts help analysts predict about likely movements in prices in the scrip, based on plotting of prices by way of charts. You can use daily data, weekly data or monthly data for depiction.

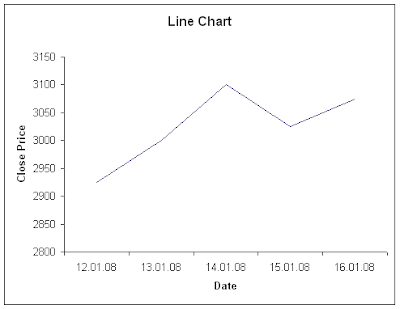

The price of a scrip across a number of days or weeks is normally plotted on the XY chart where the X axis depicts the date and the Y axis the price on each date. Thus, both price and date are plotted to give you a graphical representation. A normal price chart may be shown as following:

Price Charts

There are basically three kinds of price charts used to portray the price movements of a scrip. These are line charts or close price charts, bar charts and Japanese Candlestick charts. Each of these charts is explained by way of the following tables and figures:

Line charts or Close price charts

These charts plot only the closing price of a scrip on an XY Chart. The close prices are marked against each day and joined together by way of a straight line. For example, the close price of scrip Reliance may be plotted in a line chart as follows:

Date

|

Close Price

|

12.01.08

|

2925

|

13.01.08

|

3000

|

14.01.08

|

3100

|

15.01.08

|

3025

|

16.01.08

|

3075

|

Bar charts

A bar chart is a chart showing the high-low-close price of a scrip for a particular day. The bar, in the form of a straight line, represents these three variables and plots them against each day. The top of the line is the high price and the bottom is the low price for the day. A hash on the right hand side of the line is the close price. Sometimes, a hash on the left hand side is used to portray the open price but it is not very popular to show open price in a bar chart. Thus, graphically bar charts can be depicted in the following manner:

Japanese candlestick charts

The Japanese candlestick chart represents the open, high, low and close prices of a scrip on a daily basis. These variables are depicted by way of a candlestick. Each candlestick has two parts – a body and a shadow. The body of the candle represents the open and close price of the scrip for the day. The top of the upper shadow represents the high price and the bottom of the lower shadow, the low price for the day. A Japanese candlestick would look like this:

Japanese candlestick charts are of three types. The first one is a white candlestick, which indicates a bullish trend, as the close price is higher than the open price. A black candlestick indicates a bearish trend as the open price for the day is more than the close and the last one is called the ‘Doji’ candlestick or neutral trend, wherein the open and close prices are at the same level. These three variations of Japanese candlestick charts are shown by way of the following graphical representation: